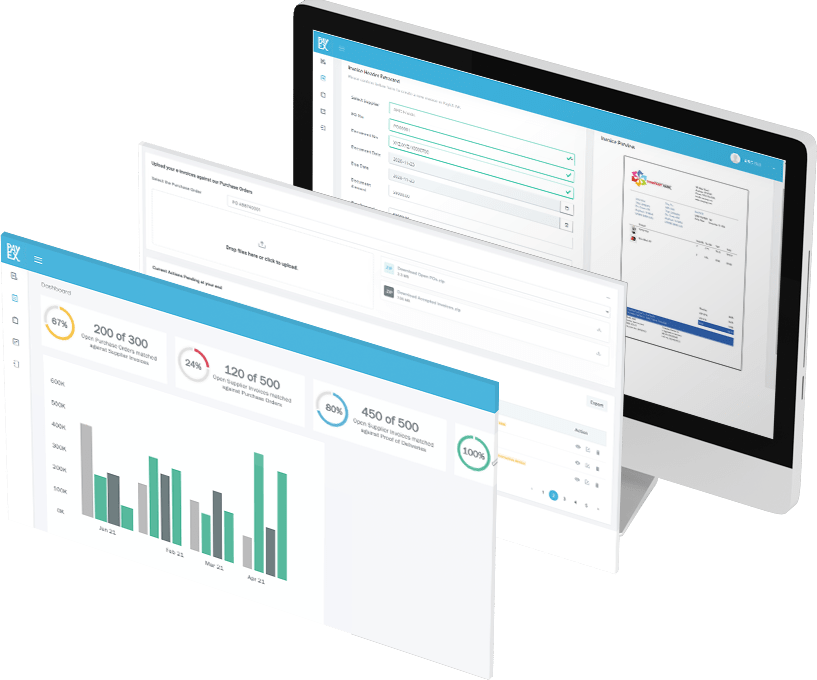

Working capital efficiencies via AR and AP automation. Buyer-seller collaboration, AI/ML tech, automated ERP accounting and more

Accept payments from around the world and reconcile transactions seamlessly to collect faster, improve cash flow, and forecast accurately

Drive collection through best-in-class customer portals with invoice delivery, integrated payments, and instant reconciliation

Say goodbye to paper invoices – embrace digital payment links and simplify your payment workflow today

Automate Cash Application with proven ML matching algorithms to achieve 95%+ straight-through cash posting direct to ERP

Drive business with hassle-free Embedded Channel Financing to improve your liquidity and cash flow predictability while minimizing customer default risk

Vendor Portal to seamlessly digitize Purchase Order (PO) delivery, effortlessly accept and validate invoices, and automate pay-outs with the added flexibility of optional financing options

Automate AR and AP processes to optimize your cash flows and working capital. Get AI/ML driven intelligent automation that enables exceptional efficiencies.

Reduce and recoup invalid deductions, reduce DSOs by ~20%, and improve customer and vendor experiences

Streamline collection, reconciliation, and pay-out to help your teams scale. Reduce manual efforts by automating data exchange and data entry with ERP, client AP portals, banks, and other data sources

Get 100% automated reconciliation for e-com marketplace sellers all the way into ERP and reduce and recoup invalid deductions

Offer AI/ML driven integrated Receivables and Payables automation solutions to your corporate and commercial banking customers

Realize new revenue streams within the B2B payments ecosystem. Achieve customer delight via integrated value-added services and stay ahead of competition

Embrace AI/ML driven digital finance transformation in AR and AP processes for your customers and deliver more value with less by utilizing SaaS automation – ROI 3x–10x

Achieve customer delight via integrated value-added services. Global applicability – across local finance, global shared services and outsourced processes

"Our accounts teams are delighted with the time & effort saved, and there are much fewer instances of accounting errors. AlgoriQ has automated every step of the reconciliation process, including identification of commission & deductions, accounting them into respective ledgers, and transferring entries to payables."

Saranyan R

Chief Finance Officer

TTK Prestige

Jyotsna Sharma

Chief Financial Officer

Bridgestone India

Jessica Chan

Director of Treasury APAC

Stanley Black & Decker

"We have been using FreePay since 2017 and the improvement and efficiency it has brought in our collections and account receivables management has been remarkable. It has helped deliver electronic invoices to our Channel Partners in real-time, and process payments with all our business terms plugged in."

Joseph Selvakumar

Vice President - Commercial

V-Guard Industries Ltd.

Ranjan Choudhury

Treasury Global Delivery Center Leader

3M

Who We Serve

Products

Resources